When considering whether to set up as self-employed, it is important to ensure that you meet the conditions set by HMRC, otherwise they could deem you to be employed, and the liability for employers NIC will fall on your “employer”.

If the answer is ‘Yes’ to all of the following questions, it will usually mean that the worker is self-employed:

- Substitution: Is it your responsibility to provide a substitute if you are ill?

- Risk: Do you take the financial risk and reward? Ie if you get it wrong to do you put it right at your own expense?

- Equipment: Do you provide your own equipment?

- Fixed price: Do you get paid a fixed amount for doing the job? Ie you do not get over time, sick pay etc.

- Self-managing: Can you say what you do any when you do it?

- Work for a variety of people: Do you do the same thing for more than one entity?

- Do not work set hours: ie it is not a 9-5 job

- Location: Does someone tell you where to work?

While this is not an exhaustive list, these are the kind of things that HMRC take into account.

You also need to be considered by HMRC as “trading”. According to HMRC there are only three reasons for purchasing as asset: 1) for personal consumption/use, 2) as an investment to provide income, and 3) for resale at a profit, ie the purpose is trading.

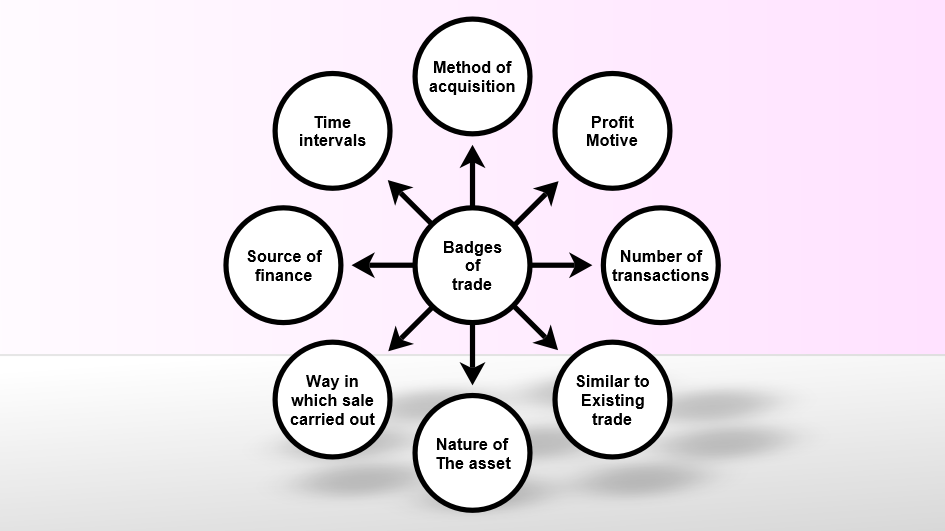

These conditions are often referred to as the “Badges of Trade”:

- Profit motive: Your motive should be to make profit – to in effect “earn a living”

- Number of transactions: Similar transactions should occur i.e. not just a one off sale of an asset. A lack of repetition generally points away from the existence of a trade.

- Similar to existing trade: ie was the transaction carried out in a manner typical of the trade in a commodity of that nature.

- Nature of the assets: Was the asset repaired, modified or improved to make it more easy to sell, or easier to sell at a greater profit.

- Way in which the sale is carried out: Was the asset sold in way in which is typical of a trading organisation or was it sold in an emergency to raise finance.

- Source of finance: Where money is borrowed (particularly via short term finance) this often indicates an intention to re-sell the asset in the short term, whereby the loan could be repaid out of the sale proceeds.

- Time intervals: holding an asset for a short period of time might indicate a trade.

- Method of acquisition: What was your intention when you purchased the item e.g. if it was a house did you originally plan to live in it. E.g. Sale of an asset that was acquired via an inheritance is less likely to constitute a trade.

Again this is not an exhaustive list as each case is considered on its individual merits.

Should you wish to discuss this further, please do not hesitate to contact us.

(Updated January 2024)